Why should a UBI Pilot be taxing?

Post by ~ Jason Leman

Early on in our discussions about running a Sheffield UBI pilot, it became clear that we can’t avoid the big issues, such as how a UBI is funded. How we think a UBI should be funded matters just as much to a pilot as to the final scheme. Below, I argue that how we fund a UBI is not just about the cost of a pilot or the final scheme, but is integral to what the function of a UBI is. As an example, let’s look at three options for funding a UBI, and the implications that has for a pilot scheme. The amount of money the UBI is set at is the same for all three options - a level that would keep people out of poverty. The amount that people would actually gain is very different.

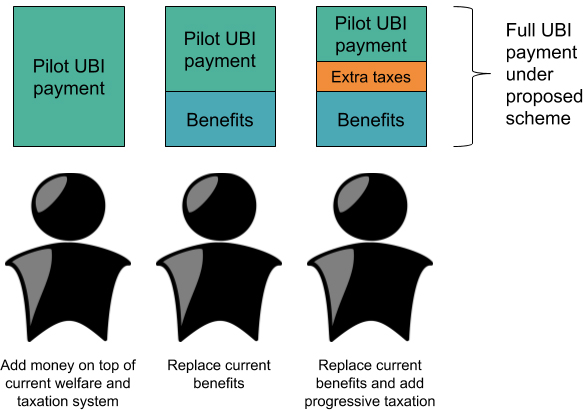

As shown in Figure 1 below, depending on whether UBI is added on top of existing taxation and benefits, or replaces benefits, or is funded by changes in taxation, greatly changes the actual UBI payments made in a pilot. Whilst the level of the UBI payments are theoretically always the same as the column on the left, the actual pilot UBI payment is steadily smaller, as benefits and taxes are adjusted for.

Figure 1 Schematic outline of pilot UBI payments for three UBI schemes

Let’s say that we ignore the current tax and benefits system completely and give out additional money to everyone. This might reflect a UBI funded through, for example, ‘helicopter money’. This is the scenario on the left in Figure 1. For a pilot, we would need to pay each person the full UBI, as we would not be adjusting the payment for any current income. This is therefore the most expensive UBI pilot, which is the 100% comparison in Figure 2 below. Aside from the cost, there are also questions of feasibility. Printing money and distributing it to everyone sounds great, but at the levels required by a reasonable UBI there is a risk ‘helicopter money’ will simply drive inflation upwards. As inflation rises, income and savings are worth less, making ‘helicopter money’ a stealth tax on income and savings. If we do not properly consider the impacts of how we fund a UBI, these impacts could end up removing any benefits of a basic income scheme. If we are to have any confidence that the results from a pilot are meaningful, then we also need to be confident that we have considered the impacts of our funding model.

Alongside the overall principle of valuing individuals through paying a UBI, we may also be interested in developing the welfare state. So, for example, a UBI scheme could replace many current benefits. For the pilot, this means giving people a UBI minus the benefits they currently receive, such as state pension and Employment Support Allowance. This is the middle option in Figures 1 and 2. As the UBI pilot payment is smaller, this is considerably cheaper to test, with a cost around three-quarters of the scheme where benefits were ignored. This example underlines that changes to how we approach the benefits system in a proposal significantly change the funding needed for a pilot scheme, and for any full UBI.

So we need to have a good idea of how we will fund a UBI and whether it is additional to, or a development of, the current welfare state. To underline how the detail matters, let’s consider the third scenario, where a progressive income tax funds a UBI. This is the model on the right of Figures 1 and 2. This scheme costs around half that of the scheme where the tax and benefits system were left untouched. We adjust the UBI given to people in the pilot according to what benefits they receive and the additional taxes they would pay under a more progressive income tax. In fact, at some income level people will become net losers, as they are required to pay more tax under the proposed UBI scheme than they do currently. Quite where the tipping point would be depends on the detail: what level of taxation is required, whether the UBI would be maintained if tax revenue fell, and whether it would only be funded through income tax. There are wider issues that it would be hard to model and where there is conflicting evidence, such as likely tax avoidance and resistance to increasing income tax. A pilot would not be able to answer all these questions, not least because most people would not voluntarily pay more taxes under a pilot scheme. However, transparency about funding would allow for a conversation to be had as part of a pilot.

Figure 2 Comparative pilot costing for three UBI schemes [1]

I favour Universal Basic Income as a means of redistributing income, profits and wealth. I would argue that a mix of funding would be best, to help rebalance the economy alongside rebalancing individual income. This may involve closing tax loopholes, raising taxes on profits or transactions, alongside a more progressive income tax model. The UK currently has a regressive tax system because of the high levels of indirect taxes that hit the poor. Yet, changing the tax system isn’t a simple option. Many tax reliefs have the intention of creating socially beneficial outcomes. Increasing indirect taxes or corporation tax significantly would impact on producers and consumers in multiple ways. Any pilot needs to include at least an outline modelling of the impact of these tax changes and have a coherent argument driving them.

Redistribution aims to smooth out the huge inequalities between people. These inequalities have far more to do with luck and position than fabled hard-work and inventiveness. It’s hard to get rich without trying, but it’s equally difficult to get out of poverty just through hard work. Our country gives us the freedom to be wealth blessed or poverty ridden, with an individual responsibility that would be welcome if it were not so wilfully ignorant of structural obstacles and cultural privileges. The UK, and England in particular, has a tradition of individual freedom that makes income redistribution a difficult topic to broach. This political challenge makes many shy away from redrawing the tax and benefit system. Yet, for the reasons set out above, a pilot cannot avoid making clear decisions.

We can present UBI as a way of valuing individuals, or developing the welfare state, or rebalancing the economy, or all three. A Universal Basic Income could buffer us from the Russian Roulette of a free market whilst removing the whip-hand of conditionality. Whatever moral basis we decide upon [2], that needs to drive decisions on funding, all of which needs to be defined and communicated in a pilot. A pilot is critical for informing us about what impact a real UBI will have, but it’s also essential for stimulating discussion about where the money comes from and why. Implementing a full UBI doesn’t just need an evidential base, but also a solid base of popular support for change. That’s why we need to start the discussion now.

[1] These three models are based on a sampled areas with a high take up of benefits and relatively low median income. For areas with a higher median income there would be a bigger difference between the middle and right options. Similarly, areas with a higher proportion of people receiving pension or other benefits would have a greater difference between the middle and left options.

[2] https://www.ubilabsheffield.org/blog/the-moral-argument-for-basic-income

More about the author

Jason Leman - Sheffield Equality Group

Sheffield Equality Group is an autonomous group affiliated to The Equality Trust, which aims to reduce the gap between rich and poor in the city of Sheffield. We argue for this because research finds this will create a better society.